Overland Park, Kan. (January 21, 2022)

QTS Realty Trust, a leading provider of data center solutions across a diverse footprint spanning more than 7 million square feet of owned mega scale data center space within North America and Europe, announced today the tax allocations of 2021 dividend distributions on its common and preferred shares.

The tables included in this press release as exhibits provide the tax treatment of dividends on QTS Realty Trust common stock and preferred stock for 2021.

For shareholders of QTS Realty Trust, Inc., the Form 1099-DIV summarizes the allocation of 2021 dividends. The amounts indicated on Form 1099-DIV should be reported on shareholders’ 2021 federal income tax returns. The exhibits below, presented on a per share basis, are provided for informational purposes only and should only be used to clarify the Form 1099-DIV. The information below has been prepared using the best available information to date. QTS Realty Trust’s federal income tax return for the year ended August 31, 2021 has not yet been filed.

On August 31, 2021, affiliates of Blackstone Infrastructure Partners, Blackstone Real Estate Income Trust, Inc., and Blackstone Property Partners completed the acquisition of QTS Realty Trust. QTS’ common stock, Series A preferred stock and Series B preferred stock is no longer listed on any public market.

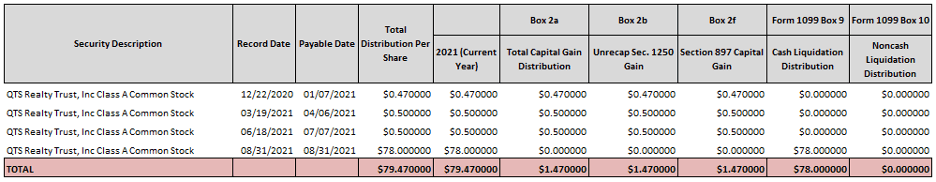

Exhibit A

Tax Treatment of 2021 Common Stock Dividends

QTS Realty Trust, Inc. (NYSE: QTS)

Common Stock Dividends

CUSIP # 74736A 103

Form 1099-DIV box 2a. Pursuant to Treas. Reg. § 1.1061-6(c), the Company is reporting that for purposes of section 1061 of the Internal Revenue Code the One Year Amounts Disclosure and the Three Year Amounts Disclosure are $0.00 with respect to direct and indirect holders of “applicable partnership interests.”

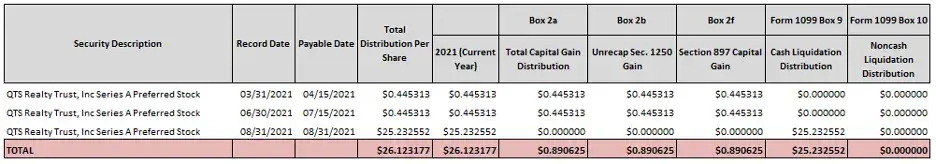

Exhibit B

Tax Treatment of 2021 Series A Preferred Stock Dividends

QTS Realty Trust, Inc. (NYSE: QTS)

Series A Preferred Stock Dividends

CUSIP # 74736A 202

Form 1099-DIV box 2a. Pursuant to Treas. Reg. § 1.1061-6(c), the Company is reporting that for purposes of section 1061 of the Internal Revenue Code the One Year Amounts Disclosure and the Three Year Amounts Disclosure are $0.00 with respect to direct and indirect holders of “applicable partnership interests.”

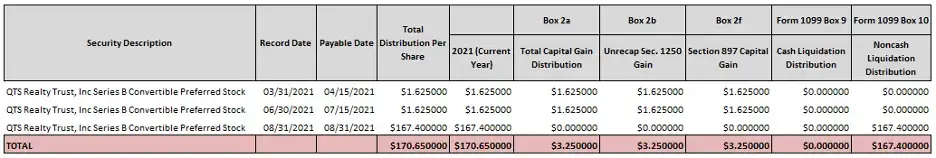

Exhibit C

Tax Treatment of 2021 Series B Cumulative Convertible Preferred Stock Dividends

QTS Realty Trust, Inc. (NYSE: QTS)

Series B Preferred Stock Dividends

CUSIP # 74736A 301

Form 1099-DIV box 2a. Pursuant to Treas. Reg. § 1.1061-6(c), the Company is reporting that for purposes of section 1061 of the Internal Revenue Code the One Year Amounts Disclosure and the Three Year Amounts Disclosure are $0.00 with respect to direct and indirect holders of “applicable partnership interests.”

About QTS

QTS Realty Trust, Inc. is a leading provider of data center solutions across a diverse footprint spanning more than 7 million square feet of owned mega scale data center space within North America and Europe. Through its software-defined technology platform, QTS is able to deliver secure, compliant infrastructure solutions, robust connectivity and premium customer service to leading hyperscale technology companies, enterprises, and government entities. QTS is a Blackstone portfolio company. Visit QTS at www.qtsdatacenters.com, call toll-free 877.QTS.DATA or follow on Twitter @DataCenters_QTS.